Joel Pacheco Gonçalves

Fixed Broadband Market Stats

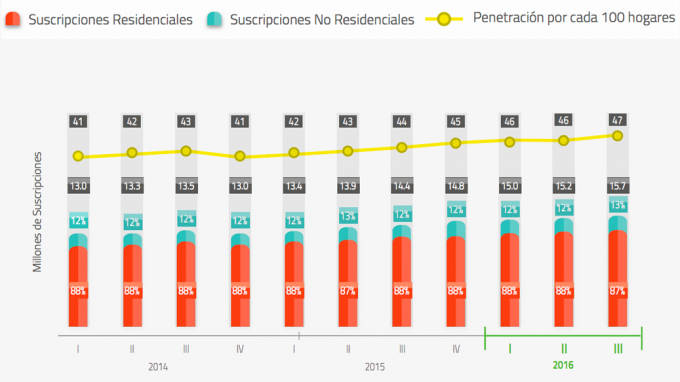

- During Q3 2016 alone, the Mexican market added 15.7 million subscribers to its fixed-line broadband business, of which 75% have speeds higher than 10Mbps.

Household Subscribers and Fixed Broadband Penetration (Source: IFT)

- The fixed line broadband market in Q3 2016 had a 9.1% growth compared to Q3 2015, which resulted in a 47% national household penetration for this trimester.

- The north of Mexico has a larger household penetration, surpassing 60% in all border states.

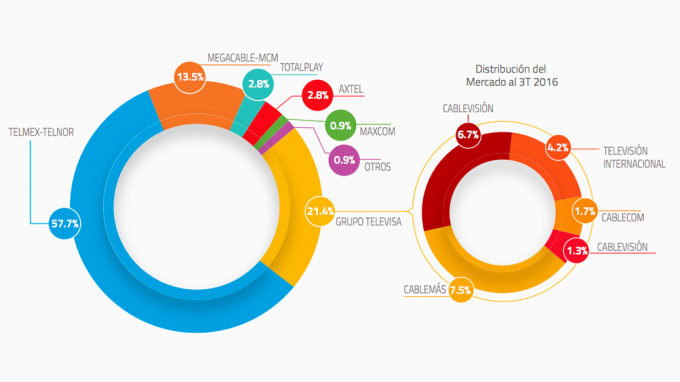

- The fixed line broadband market share has three major participants. Telmex-Telnor is leading with a 57.7%, followed by Televisa with a 21.4% and Megacable-MCM with 13.5% of participation.

- Regarding connectivity technology, DSL represented 48.8% of subscribers, followed by a 34.9% in Coaxial Modems and a 14.3% in Fiber Optics.

Fixed Broadband Market Share in Mexico (Source: IFT)

Mobile Broadband Market Stats

- Mobile subscribers reached 110 million resulting in a 90% national penetration.

- Mobile broadband subscribers grew 24% to 71.6 million compared to the same trimester last year, reaching a 58% penetration throughout Mexico.

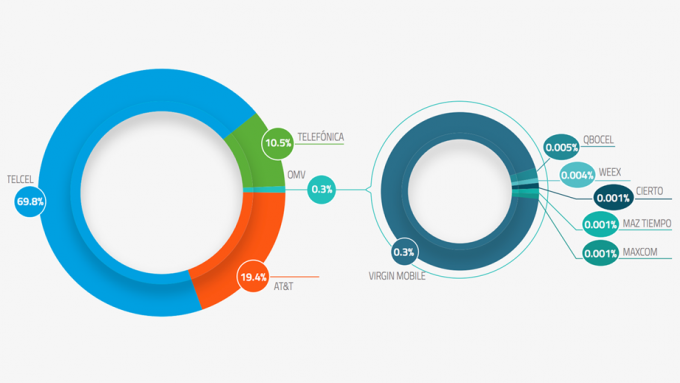

- Telcel leads the mobile business with a 65.7% of the market, followed by Telefónica and AT&T with 26.2% and 6.5% respectively.

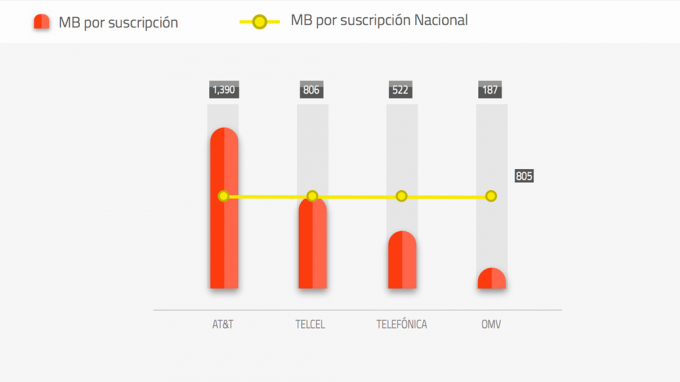

- The monthly average data consumption per subscriber reached 805MB, with AT&T topping the ranking of wireless carriers averaging 1,390MB per subscriber.

Average Data Traffic per Subscriber (Source: IFT)

- Regarding total data traffic by 3Q 2016, Telcel is the wireless carrier with most data exchange with 122 billion of MB or 122,000 TB (69,8%), while AT&T and Telefonica followed with 33.8 (19,4%) and 18.8 (10,5%) billion of MB respectively.

Data Traffic Share by Mobile Operator (Source: IFT)

Continuous growth after the telecom reform

Mexico’s annual fixed broadband market growth was 9.1% by 3Q 2016, bested only by China (18.7%) and Turkey (9.7%), and although mobile broadband penetration in Mexico is not yet equal to US or European levels, its ever-increasing growth by Q3 2016 sustained a year-over-year rate of 23.6%.

If you want more insight about the Mexican market, you may want to take a look at this post